By Ritesh Sonavane on Jun 7, 2019 5:33:43 PM

First, you have to congratulate yourself because you are among a very few people in our country who has the monetary power to "invest" in a real estate property.

Both residential and commercial spaces have their advantages and disadvantages. Though commercial properties yield high rental returns, they are also costly in comparison to residential properties. On the other hand, residential properties are bought primarily as a long-term investment.

The demand for commercial spaces has grown tremendously over the years, with new residencies and townships, the price of commercial spaces have steadily moved upwards.

Presently, growth in capital and rental values of commercial real estate is growing. Whereas, residential real estate has remained mostly stagnant in the past few years - regularly changes and excessive supply are tentative reasons.

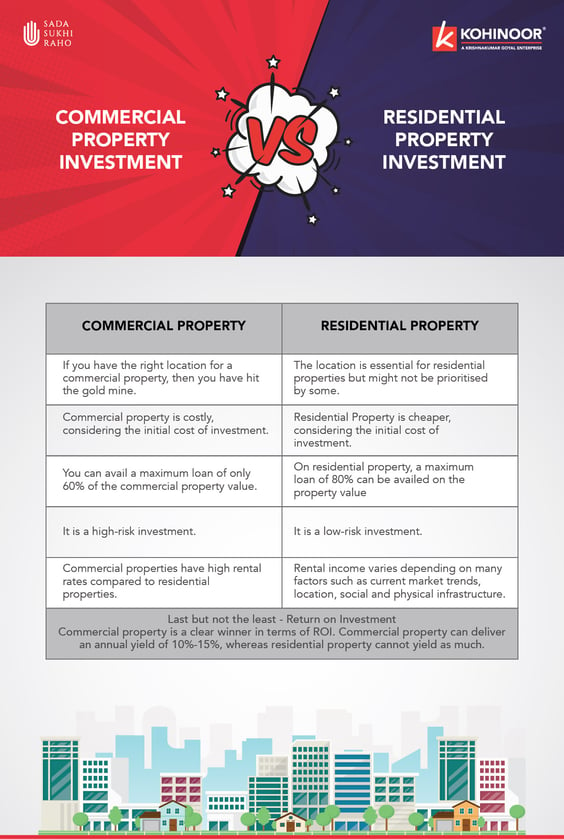

Commercial Property Investment Vs Residential Property Investment

Difference between Commercial Property and Residential Property Investment

Commercial Property |

Residential Property |

| If you have the right location for a commercial property, then you have hit the gold mine. | The location is essential for residential properties but might not be prioritised by some people. |

| Commercial property is costly, considering the initial cost of investment. | Residential Property is cheaper, considering the initial cost of investment. |

| You can avail a maximum loan of only 60% of the commercial property value. | On residential property, a maximum loan of 80% can be availed on the property value |

| It is a high-risk investment | It is a low-risk investment |

| To earn a regular income, commercial properties offer excellent investment opportunities because they have high rental rates compared to residential properties. | In the case of residential properties, rental income depends on many factors such as current market trends, location, social and physical infrastructure. |

Last but not least; Return on Investment or ROI plays a vital role in the investment decision. So, let’s understand it a little more in detail -

Commercial property is a clear winner in terms of ROI. It is important to remember that commercial property has the potential to deliver an annual yield of 10%-15%, whereas residential property cannot yield more than 4% under any circumstances.

Figures may vary, but a significant margin always persists between both. One more thing which is often forgotten by many is that there are no tax benefits available on loan for commercial property. However, residential property loan does offer tax incentives.

Overall, there isn’t a clear winner and it comes down to preference and need. If you want high risk and high returns then go for commercial property investment. On the other hand, if your goal is stability on the cost of low returns then a residential investment will suit you best.

Related Post - Which Are the Top Locations to Buy Real Estate Properties in Pune in 2022?

comments